The IRS Power of Attorney Form 2848 can be executed to authorize another person to represent you before the IRS. The individual you designate must be a person eligible to practice before the IRS such as an attorney, preferably a competent tax attorney.

For the most recent version of this form, visit the Internal Revenue Service website.

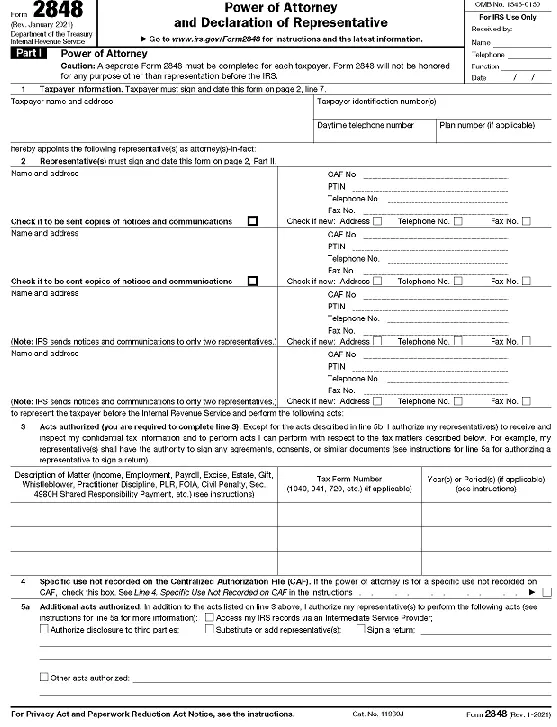

You can use Form 2848 to authorize an individual to represent you before the IRS. The individual you authorize must be a person eligible to practice before the IRS. Your authorization of the representative will also allow that person or business entity to receive and inspect your confidential tax information. 1

Select the appropriate file to download the IRS Power of Attorney Form 2848 in either Microsoft Word or PDF format. The PDF has fillable fields into which you can type the required information.

Printable IRS Power of Attorney Form 2848

Microsoft Word

Printable IRS Power of Attorney Form 2848 Word

Printable PDF

Printable IRS Power of Attorney Form 2848 PDF

Example of IRS Form 2848

How To Fill Out IRS Form 2848

Lines to be Completed on IRS Power of Attorney Form 2848

- Line 1 – Taxpayer Information

- Line 2 – Representative(s)

- Line 3 – Acts Authorized

- Line 4 – Specific Use Not Recorded on the CAF

- Line 5a – Additional Acts Authorized

- Line 5b – Specific Acts Not Authorized

- Line 6 – Retention/Revocation of Prior Power(s) of Attorney

- Line 7 – Taxpayer Declaration and Signature

- Part II – Declaration of Representative (to be completed by the person you are authorizing to represent you on IRS matters.

Will Forms — Trust Forms — Search For Legal Forms — Printable Legal Forms — Bill of Sale Forms — Personal Legal Forms — Business Legal Forms