We offer several types of Blank Will Forms To Print. These are Printable will forms. A standard will is referred to as a “last will and testament.” The will specifies how the person’s assets will be distributed and who will be in charge of the distribution. The standard will is suited for individuals and couples with total assets (including life insurance and retirement plans) of less than the exclusion threshold for the federal estate tax, which is currently $11,580,000 for a single person and $23,160,000 for a married couple.

We offer much more than just standard blanks wills. For most of us, life is anything but standard. We offer wills for the most common everyday situations. The most popular will we offer is for persons who are remarried and have children from one or both marriage(s).

Will form templates can be edited or customized to suit just about any situation. If you’re widowed, edit the template and mention your spouse by name as having preceded you. If you’ve been married three times, be sure to mention the ex’s by name along with your current spouse. If you have 12 kids, add lines to the template to ensure that you list each child by name.

Commonly Asked Questions Concerning Wills

Where can I get a blank will form?

To access the blank will forms that we offer, visit our Wills By Type section near the top of this page. If we don’t have the particular type of blank will form you’re searching for, we recommend visiting AARP or any reputable resource site.

Does a will need to be notarized?

In most cases the answer is no. At the present time the only state that requires a will to be notarized is Louisiana

How do I change my will?

Can you make a will without a lawyer?

What happens if I don’t name all of my children in the will?

All heck will break loose the second you die. Nothing brings out the nasties faster than a child finding out he or she was passed over in favor of other siblings. You should mention every child by name in the will, even if you have no intention of leaving that person any of your estate. One common phrase used in wills is “I leave you all of my love but no material possessions.”

What is a self-proved will?

Most states consider a will to be “self-proved” if it was signed by the grantor, signed by two witnesses, and notarized. The witnesses must sign the will under penalty of perjury that they watched the person sign the will.

Some states do not allow for self-proved wills. In the District of Columbia, Vermont, Maryland, and Ohio, the option to consider a will self-proved is not available. In California, Indiana, and New Hampshire, it’s not necessary to have a separate affidavit for witnesses to sign. The will itself usually includes a statement that under penalty of perjury, the witnesses state that to the best of their knowledge, the grantor was of legal age, not under undue influence, and mentally competent to sign the will.

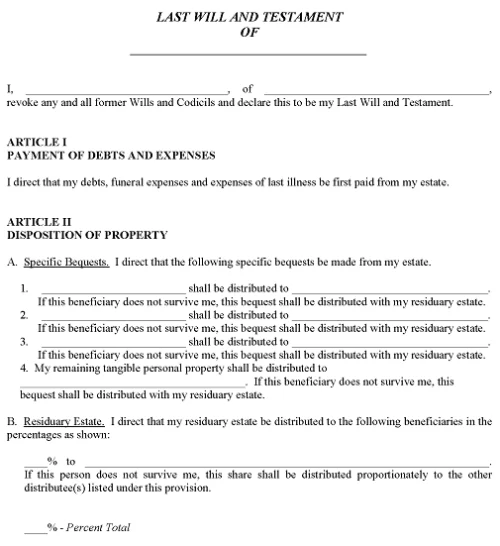

Example of a Blank Will Form

Blank Will Forms By Type

Printable Do It Yourself Wills For All 50 States

Printable Do-It-Yourself Will Kit

Printable Joint Will For Married Couple

Printable Revocation of Living Will Form

Printable Simple Will For Married Person

Printable Simple Will For Single Person

Printable Simple Will Forms To Print

Printable Will For Grandparent

Printable Will For Married Person With Children

Printable Will For Remarried Person With Children

Printable Blank Will Forms By State

Printable Alabama Blank Will Forms

Printable Alaska Blank Will Forms

Printable Arizona Blank Will Forms

Printable Arkansas Blank Will Forms

Printable California Blank Will Forms

Printable Colorado Blank Will Forms

Printable Connecticut Blank Will Forms

Printable Delaware Blank Will Forms

Printable Florida Blank Will Forms

Printable Georgia Blank Will Forms

Printable Hawaii Blank Will Forms

Printable Idaho Blank Will Forms

Printable Illinois Blank Will Forms

Printable Indiana Blank Will Forms

Printable Iowa Blank Will Forms

Printable Kansas Blank Will Forms

Printable Kentucky Blank Will Forms

Printable Louisiana Blank Will Forms

Printable Maine Blank Will Forms

Printable Maryland Blank Will Forms

Printable Massachusetts Blank Will Forms

Printable Michigan Blank Will Forms

Printable Minnesota Blank Will Forms

Printable Mississippi Blank Will Forms

Printable Missouri Blank Will Forms

Printable Montana Blank Will Forms

Printable Nebraska Blank Will Forms

Printable Nevada Blank Will Forms

Printable New Hampshire Blank Will Forms

Printable New Jersey Blank Will Forms

Printable New Mexico Blank Will Forms

Printable New York Blank Will Forms

Printable North Carolina Blank Will Forms

Printable North Dakota Blank Will Forms

Printable Ohio Blank Will Forms

Printable Oklahoma Blank Will Forms

Printable Oregon Blank Will Forms

Printable Pennsylvania Blank Will Forms

Printable Rhode Island Blank Will Forms

Printable South Carolina Blank Will Forms

Printable South Dakota Blank Will Forms

Printable Tennessee Blank Will Forms

Printable Texas Blank Will Forms

Printable Utah Blank Will Forms

Printable Vermont Blank Will Forms

Printable Virginia Blank Will Forms

Printable Washington Blank Will Forms

Printable Washington DC Blank Will Forms

Printable West Virginia Blank Will Forms

Printable Wisconsin Blank Will Forms

Printable Wyoming Blank Will Forms

State Laws Governing Wills

Printable Power of Attorney Forms — Printable Will Forms — Printable Trust Forms — Search For Legal Forms — Printable Legal Forms — Printable Bill of Sale Forms — Printable Personal Legal Forms — Printable Business Forms