We offer the most common types of Trust Forms. There are several types of trusts. The most common is a joint revocable trust established by parents or grandparents. Trusts can be revocable or irrevocable. There are several other types of trusts, most designed to reduce the financial impact of income taxes. These include the Asset Protection Trust, Charitable Trust, Constructive Trust, Special Needs Trust, Spendthrift Trust, and the Tax Pass-By Trust.

We do not offer legal forms for any type of business trust. Our forms consist of personal trusts commonly executed by families.

All of our trust forms are available in Microsoft Word and PDF. You can print the form and fill in the blanks. You can also edit or customize the form using an appropriate document editing software such as Word or Adobe Acrobat.

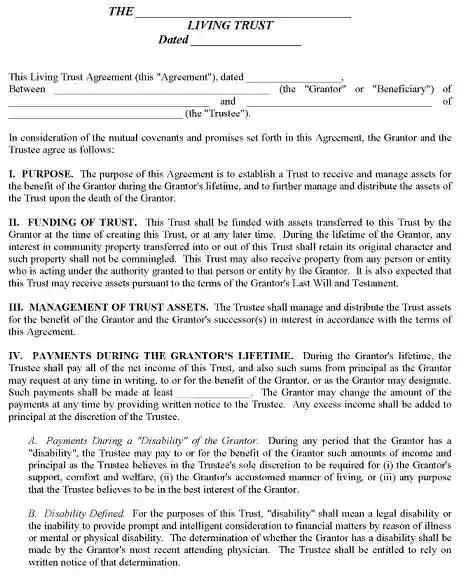

Example of a Living Trust Form

Printable Trust Forms By Type

PRINTABLE DECLARATION OF TRUST FORMS BY STATE

PRINTABLE JOINT LIVING TRUST FORMS BY STATE

PRINTABLE LIVING TRUST AMENDMENT FORMS BY STATE

PRINTABLE REVOCABLE LIVING TRUST FORMS BY STATE

PRINTABLE REVOCATION OF LIVING TRUST FORMS BY STATE

PRINTABLE REVOCATION OF TRUST FORMS BY STATE

Printable Trust Forms By State

Printable Arkansas Trust Forms

Printable California Trust Forms

Printable Colorado Trust Forms

Printable Connecticut Trust Forms

Printable Delaware Trust Forms

Printable Illinois Trust Forms

Printable Kentucky Trust Forms

Printable Louisiana Trust Forms

Printable Maryland Trust Forms

Printable Massachusetts Trust Forms

Printable Michigan Trust Forms

Printable Minnesota Trust Forms

Printable Mississippi Trust Forms

Printable Missouri Trust Forms

Printable Nebraska Trust Forms

Printable New Hampshire Trust Forms

Printable New Jersey Trust Forms

Printable New Mexico Trust Forms

Printable New York Trust Forms

Printable North Carolina Trust Forms

Printable North Dakota Trust Forms

Printable Oklahoma Trust Forms

Printable Pennsylvania Trust Forms

Printable Rhode Island Trust Forms

Printable South Carolina Trust Forms

Printable South Dakota Trust Forms

Printable Tennessee Trust Forms

Printable Virginia Trust Forms

Printable Washington Trust Forms

Printable West Virginia Trust Forms

Printable Wisconsin Trust Forms

Revocable Trusts

Revocable trusts are also known as living trusts. A revocable trust allows the transfer of assets without probate, yet they allow you to retain control of the assets during your lifetime. A revocable trust is flexible and can be dissolved at any time. A revocable trust typically becomes irrevocable when the grantor dies.

Irrevocable Trusts

Irrevocable trusts typically transfer assets out of your estate and often avoid estate taxes and probate. An irrevocable trust cannot be changed by the grantor after it has been executed. Once you execute an irrevocable trust, you lose control of the assets and cannot change any terms or decide to dissolve the trust.

Joint Trusts

Joint trusts are typically set up by a married couple. Unless specified in the trust agreement, a joint trust is revocable. Some agreements state that the trust can be revoked only by the consent of both spouses. This is a legal protection to cover both spouses in the event of a divorce. Grandparents often execute joint trusts to benefit their grandchildren. Often upon the death of both grandparents, the remainder of the trust is either given to the grandchildren if they are of age or remains in the trust until the grandchildren reach the age specified in the trust agreement.

Common Questions About Trusts

These completely free trust forms along with most other legal records presented free on this web page are supplied “as is” without intended or implied warranties. This also includes, yet is not limited to, warranty of merchantability or fitness for any type of kind of certain use.

These completely free trust forms were not generated by a legal professional or law practice. If the document is legally appropriate for your criteria, it is your responsibility to determine. If required, you have to likewise make sure that the form is properly filled out as well as likewise witnessed.

As a visitor of this website, you assume all culpability together with answerability for executing as well as using the trust forms. We do not assume any kind of legal liability or commitment for the accuracy and reliability or functionality of the legal instruments.

By saving, printing, or using any of the trust forms, you recognize that we will not be held accountable for injuries or losses, whether absolute or indirect, deriving from the loss of use or loss of revenues arising from the application or implementation of the legal forms or the form templates supplied on this site.

Will Forms — Trust Forms — Search For Legal Forms — Printable Legal Forms — Bill of Sale Forms — Personal Legal Forms — Business Legal Forms