The Pennsylvania last will and testament, also known as a will, is a legal document that details the testator’s wishes regarding the distribution of their assets, the upbringing of their children, and other matters after their passing. A personal representative, also known as an executor, is a responsible individual appointed to oversee the distribution of the estate in compliance with the terms of the will.

Our Pennsylvania Wills are printable and can be downloaded in case you want to edit or customize the document. We have wills for persons with and without children, and for those who are single, married, and remarried. We also have a specialized will for grandparents.

State Statute Governing Pennsylvania Wills

Pennsylvania Consolidated Statutes Title 20, Chapter 25

Pennsylvania Will Age Requirements

Age Requirements: Any person 18 or more years of age who is of sound mind may make a will.

Pennsylvania Will Signing Requirements

Will Signing Requirements: Every will shall be in writing and shall be signed by the testator at the end thereof or signed by another person at the direction of the testator. (Pennsylvania Consolidated Statutes Title 20, Chapter 25 Section 2502)

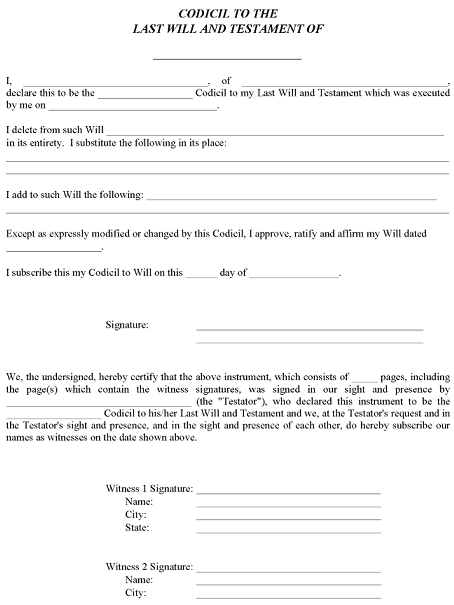

Revoking A Pennsylvania Will

A Pennsylvania will may be revoked by another will or codicil in writing, by some other writing declaring the same, executed and proved in the manner required of wills, or by being burnt, torn, canceled, obliterated, or destroyed, with the intent and for the purpose of revocation, by the testator himself or by another person in his presence and by his express direction.

Pennsylvania Will Witness Requirements

Will Witnessing Requirements: The requirement that a will be witnessed was repealed by the state legislature on 12/10/1974.

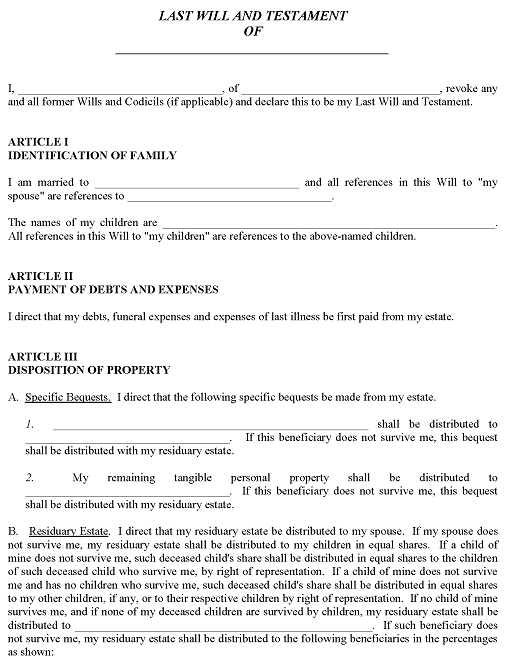

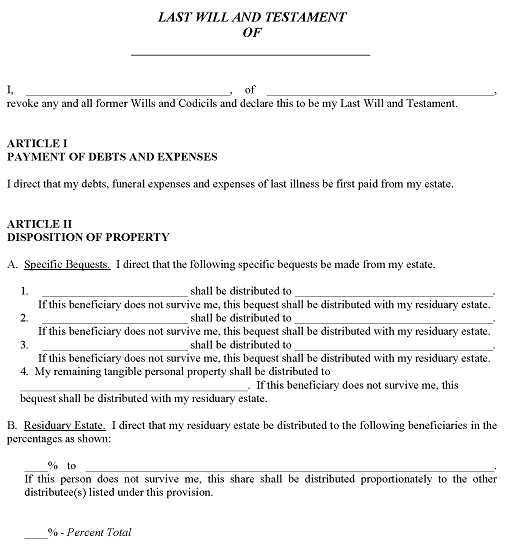

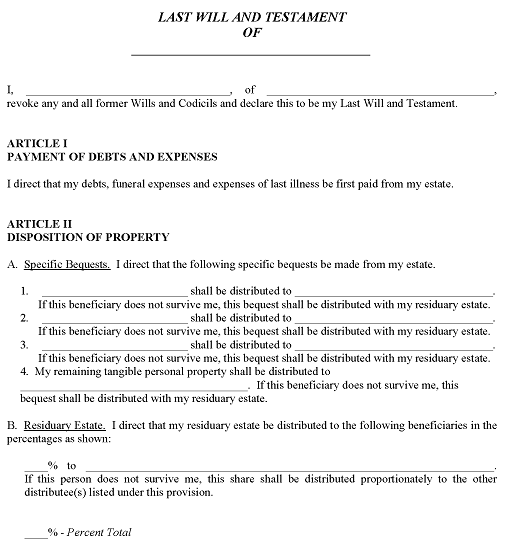

Example of Pennsylvania Last Will and Testament

Printable Pennsylvania Last Will and Testament Forms

Printable Microsoft Word

Printable Pennsylvania Last Will and Testament Microsoft Word

Printable PDF

Printable Pennsylvania Last Will and Testament PDF

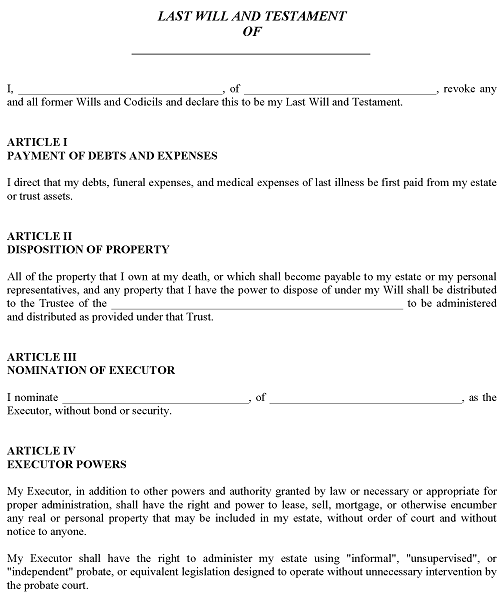

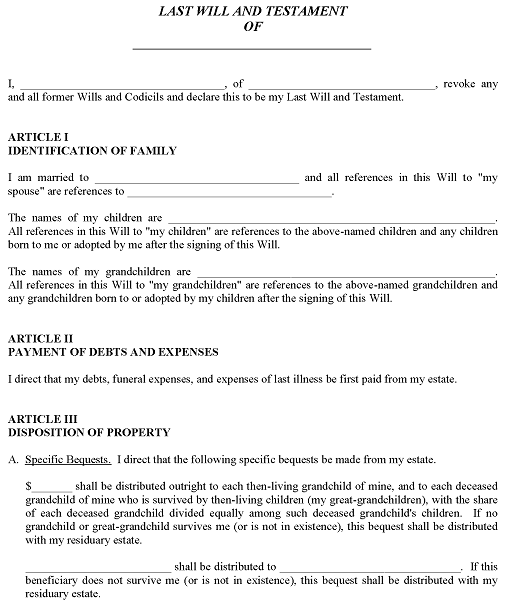

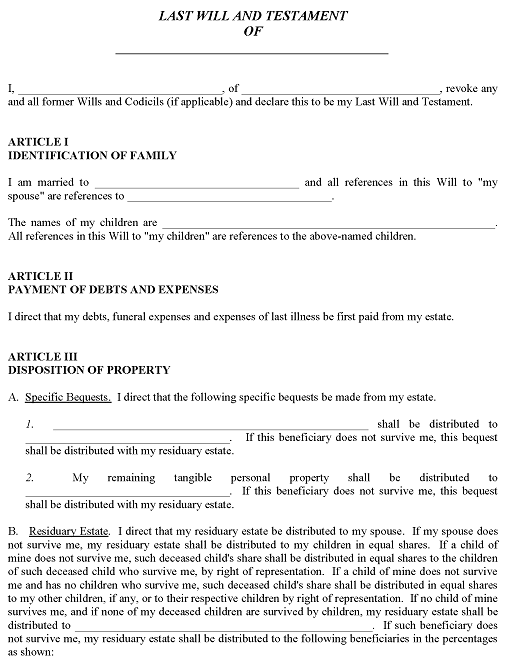

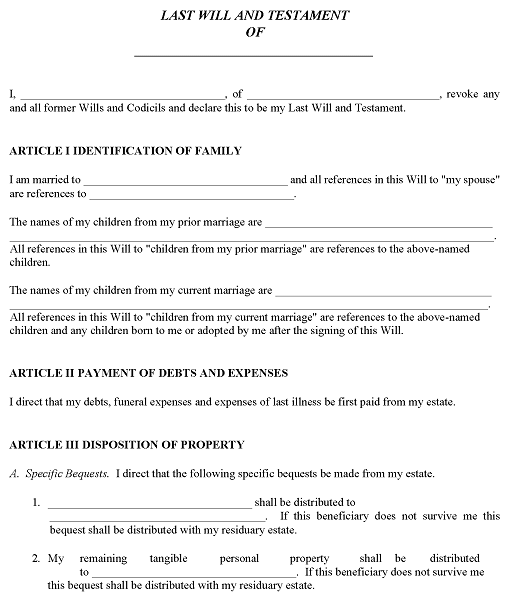

Other Printable Pennsylvania Last Will and Testament Forms

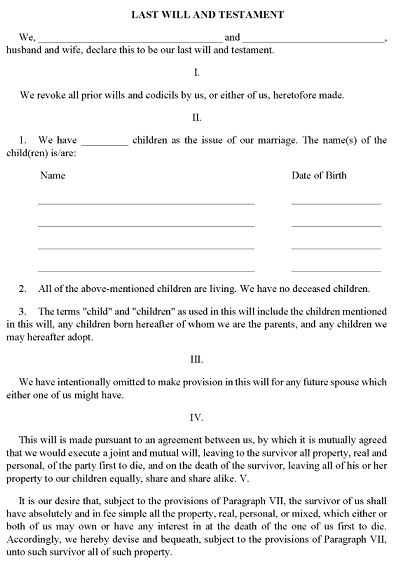

Printable Joint Will For Married Couple

Printable Simple Will For Married Person

Printable Simple Will For Single Person

Printable Will For Grandparent

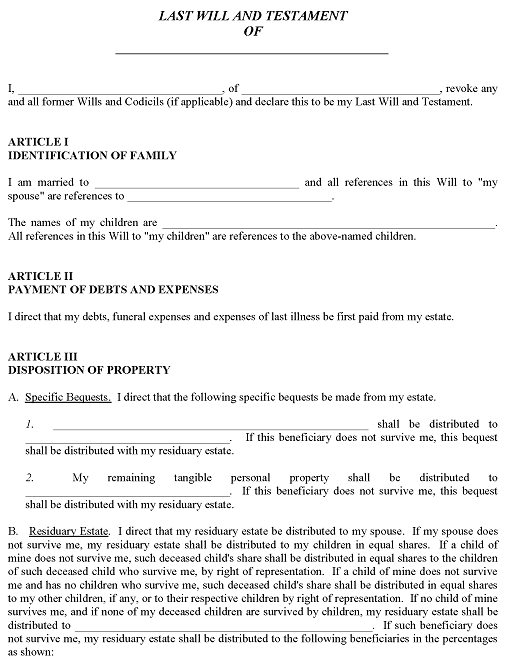

Printable Will For Married Person With Children

Printable Will For Remarried Person With Children

Will Forms — Trust Forms — Search For Legal Forms — Printable Legal Forms — Bill of Sale Forms — Personal Legal Forms — Business Legal Forms